As of 1 July 2018 the tax rate of 15 was reduced to 10 on annual net income derived by an individual of up to 650000 Mauritian rupees MUR. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

Income Tax Basic Concepts A Comprehensive Guide Tax2win

Personal income tax rates.

. How To File Your Taxes For The First Time. Note that if you work for a Thai company with an International Business Center IBC status have a tax-residency status in Thailand make a. Estimate your personal income taxes in each province and territory with our Income Tax Calculator for Individuals.

Most of the property. As you mightve noticed tax rates are comparable to most other countries so the assumption that Thailand is a tax haven is untrue. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. In the case of allowances there is a provision to carry forward the unutilized allowances until it is. Income from employment duties performed in Mauritius is deemed to have been derived from Mauritius even if the related remuneration is received outside Mauritius.

Everything You Should Claim As Income Tax Relief Malaysia 2022 YA 2021 Malaysia Personal Income Tax Guide 2022 YA 2021. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. If you have any other questions about filing your tax income do check out our Income Tax page or any of these articles below.

To calculate your tax bill and marginal tax. Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. The main source of personal income tax for expats in Thailand is through employment.

Simply click on the year and enter your taxable income.

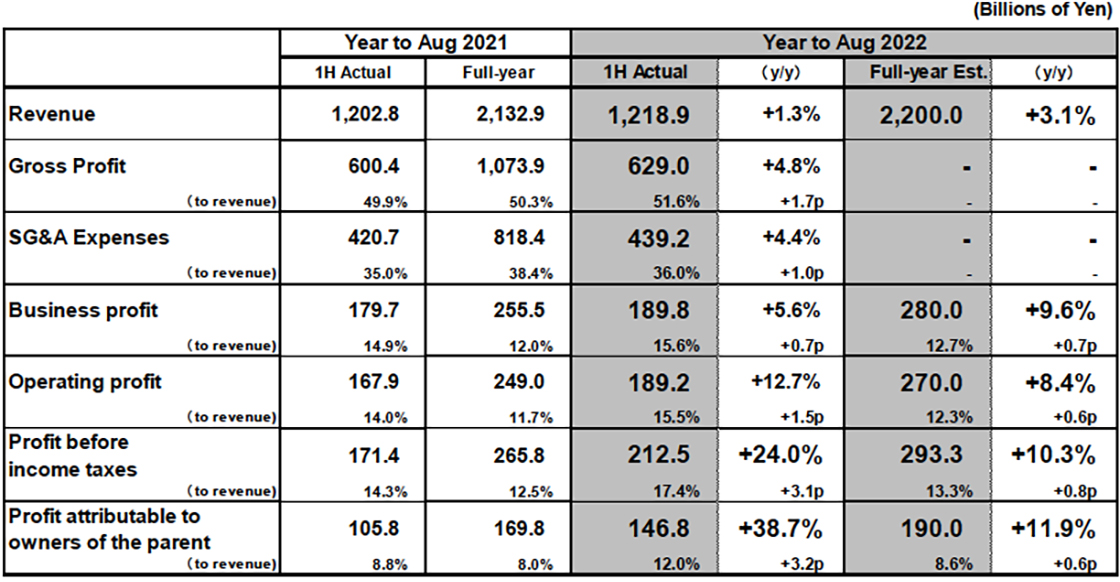

Results Summary Fast Retailing Co Ltd

New Zealand Economist Keith Rankin S December 2018 Chart Titled Crisis Postponed Suggests That While There Is More Than Learning Time Rankin Economic Trends

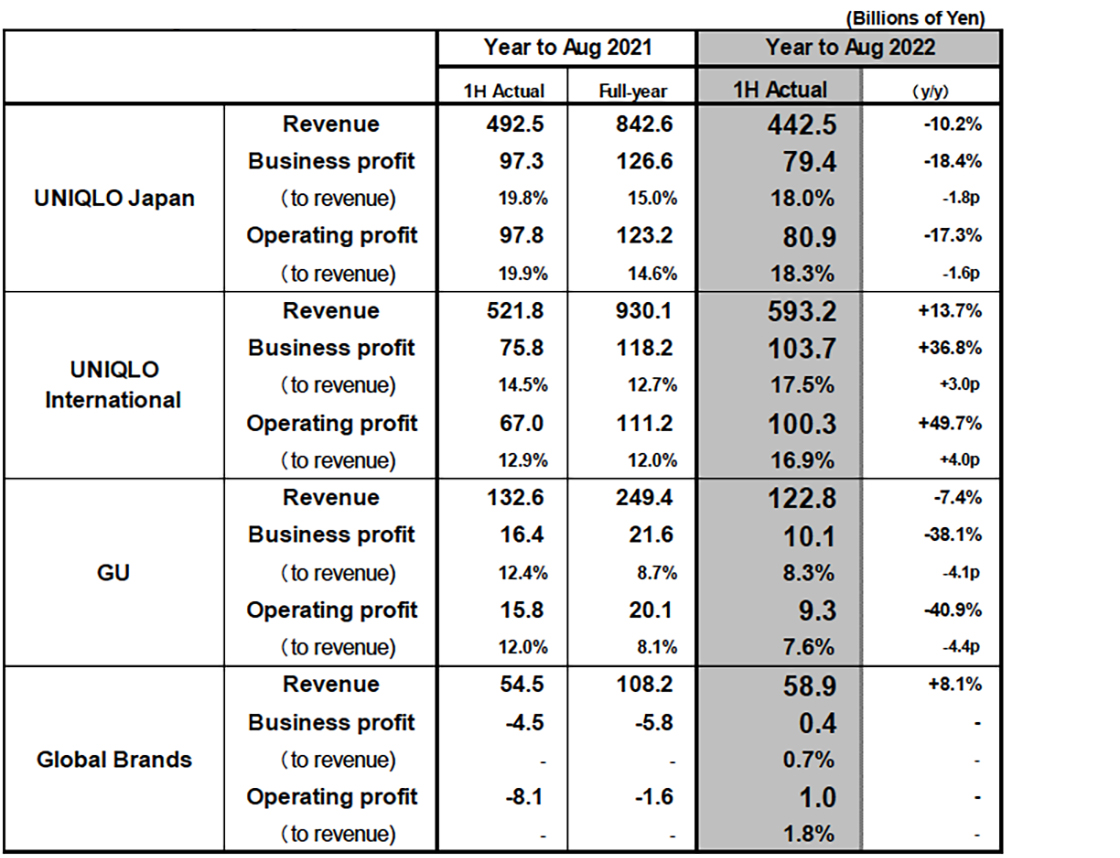

Results Summary Fast Retailing Co Ltd

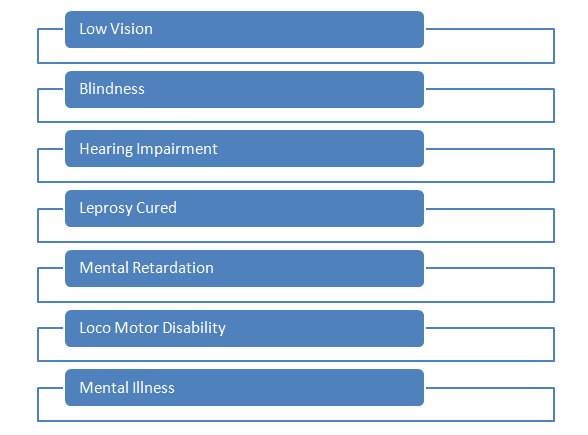

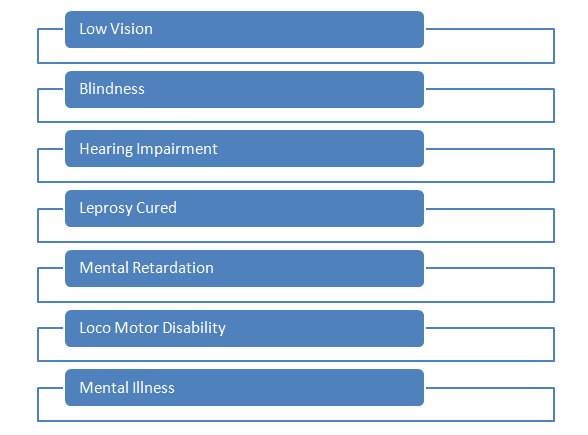

Section 80u Income Tax Deduction Under Section 80c

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

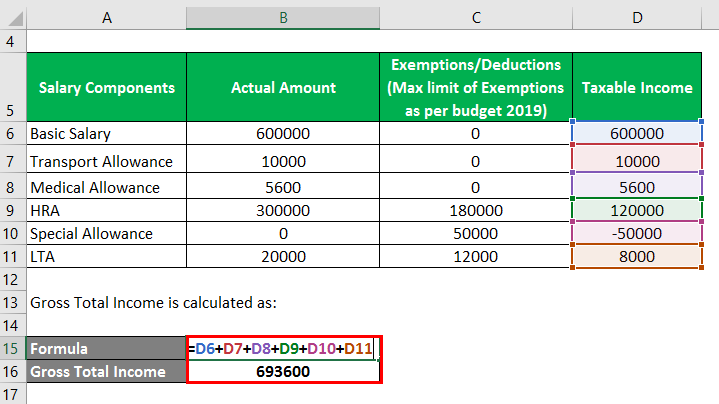

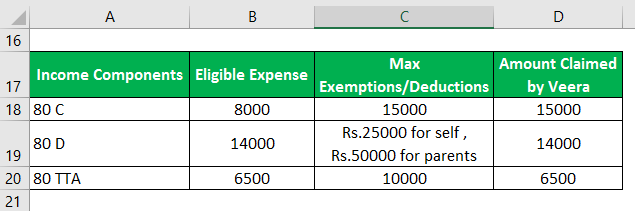

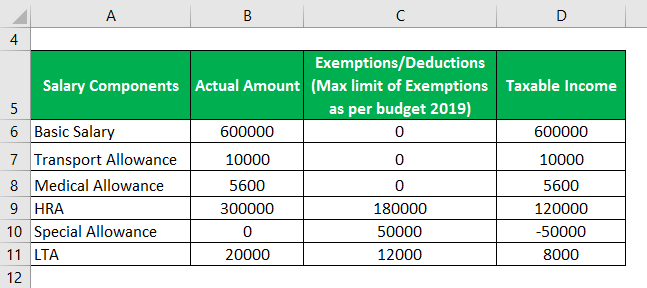

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Income Tax Basic Concepts A Comprehensive Guide Tax2win

Pin On Datesheets Notifications

Pressure To Raise Taxes Anticipated The Star

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Download Teacher Salary Slip Excel Format Exceltemple Teacher Salary Free Resume Template Word Teacher Help

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Taxable Income Formula Calculator Examples With Excel Template